Introduction: The 2026 Real Estate Dilemma: Opportunity or Trap?

As we head into 2026, a pivotal question weighs on the minds of investors: Is putting capital into property still a smart move in a dynamically shifting economic landscape? Did you know that despite recent interest rate hikes, US home prices have still seen a median increase of approximately 5% year-over-year in many key markets as of late 2025? This resilience, however, is met with growing affordability concerns and evolving investment avenues. As noted by Dr. Lena Khan, Chief Economist at Global Housing Analytics, “The 2026 housing market isn’t about finding a cheap property; it’s about discerning genuine value and understanding the multifaceted ways to engage with real estate.”

This comprehensive guide will cut through the noise, providing a data-driven analysis of the current US housing market, followed by a detailed comparison of direct property ownership, Publicly-Traded Real Estate Investment Trusts (REITs), and Real Estate Crowdfunding. Our goal is to equip you with the insights needed to make an informed decision aligned with your personal financial goals and risk tolerance.

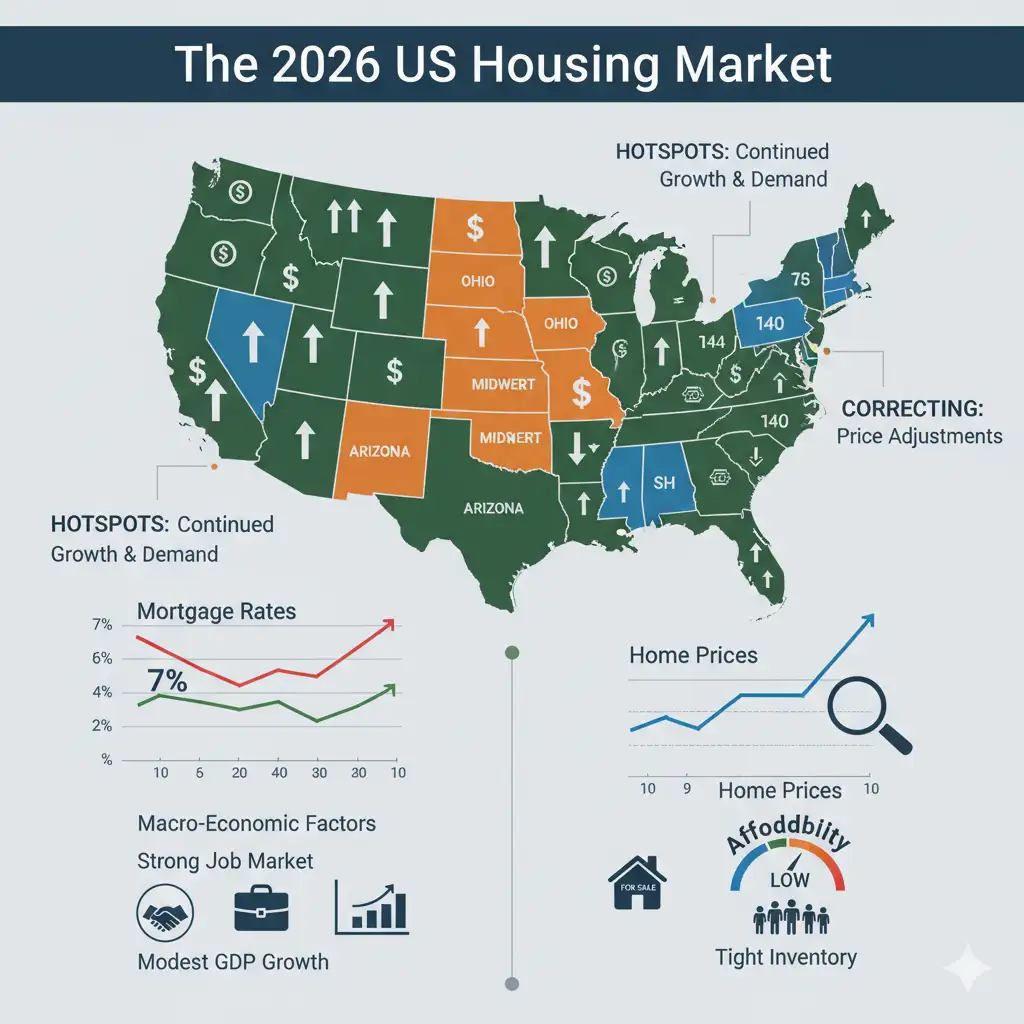

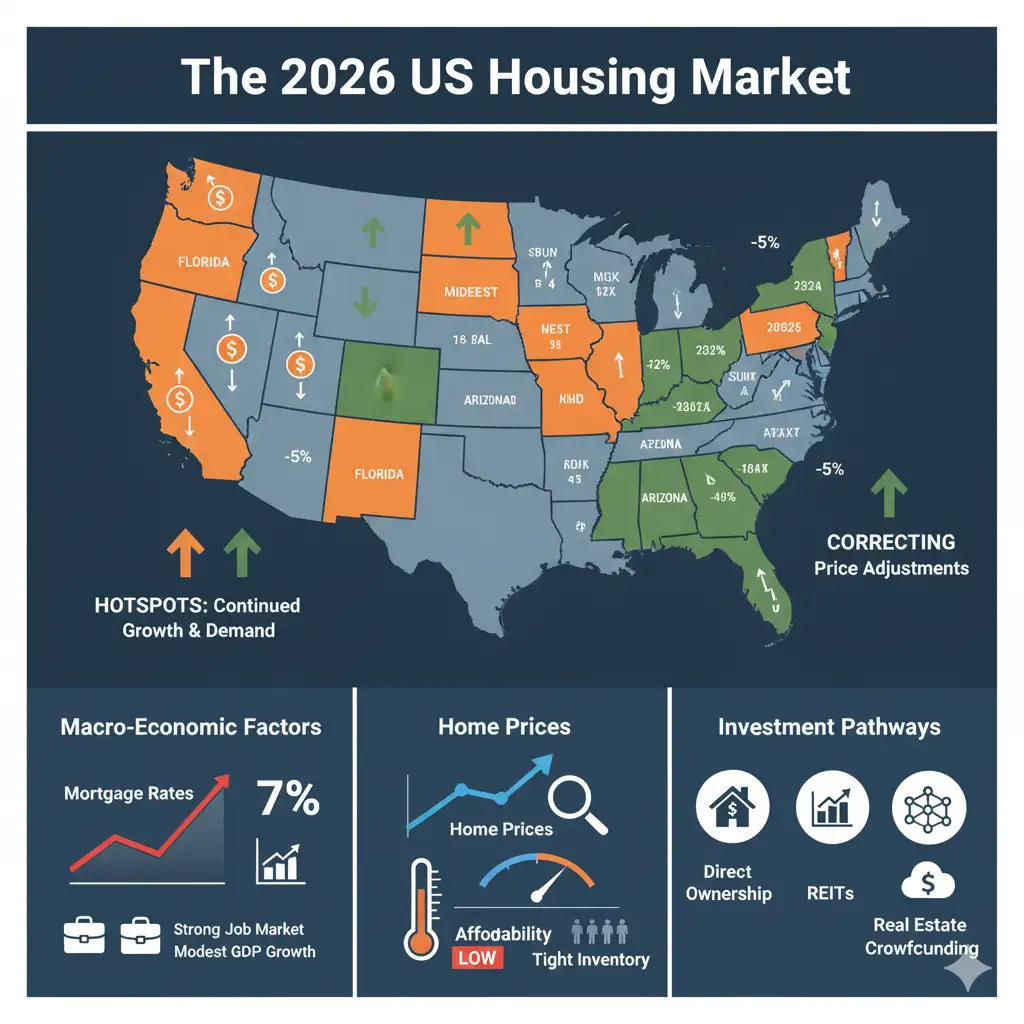

The 2026 US Housing Market: A Data-Driven Analysis

The US housing market entering 2026 is a complex tapestry woven from macro-economic factors and specific market indicators. Understanding these elements is crucial for any potential investor.

Macro-Economic Factors

The Federal Reserve’s recent interest rate policies continue to be the primary driver. While inflation has shown signs of moderation, the Fed’s cautious approach to rate cuts has kept mortgage rates elevated compared to the ultra-low levels of previous years. Freddie Mac’s latest projections indicate the average 30-year fixed mortgage rate hovering around 6.5-7.0% by early 2026, impacting buyer affordability. Simultaneously, a robust, albeit slowing, job market and modest GDP growth suggest underlying economic strength, providing some support to housing demand.

Market-Specific Indicators

Despite higher mortgage rates, housing inventory across the nation remains relatively tight, especially for starter homes. This supply-demand imbalance, though easing in some regions, continues to exert upward pressure on prices. The S&P/Case-Shiller Home Price Index shows a continued, albeit decelerating, national appreciation, with significant regional disparities. The Housing Affordability Index confirms that while wages have grown, they haven’t kept pace with the combined rise in home prices and mortgage rates, pushing homeownership out of reach for many first-time buyers. However, this creates opportunities for investors in rental markets.

Regional Outlook

Certain areas, particularly in the Sun Belt states like Florida and Texas, continue to experience population growth and strong demand, maintaining price appreciation. Conversely, some West Coast markets might see further price corrections as tech sector growth slows and inventory gradually increases.

Investment Pathways: A Professional Comparison Matrix

Given the evolving market, deciding how to invest in real estate is as critical as deciding if to invest. Here’s a professional breakdown of the three primary avenues:

| Feature | Direct Property Ownership | Publicly-Traded REITs | Real Estate Crowdfunding |

|---|---|---|---|

| Ideal Investor Profile | The Entrepreneur (Hands-on, high net worth) | The Diversifier (Passive, all experience levels) | The Modern Speculator (Risk-tolerant, seeks specific deals) |

| Capital Required | Very High ($50,000+ for down payment) | Very Low (Cost of 1 share, ~$20-$200) | Low to Moderate ($500 - $10,000) |

| Risk Level | High (Market, tenant & concentration risk) | Medium (Diversified, but subject to market risk) | High to Very High (Project failure & platform risk) |

| Liquidity | Very Low (Can take months or years to sell) | Very High (Can be sold on any trading day) | Very Low (Money is locked in for 2-10 years) |

| Tax Advantages | Excellent (Depreciation, deductions, 1031 exchange) | Good (No corporate tax; dividends are taxed) | Varies (Depends on the investment structure) |

| Potential Return | High (Appreciation + rental income) | Moderate (Dividends + share price growth) | Potentially Very High (But with higher risk) |

Choosing Your Path: A Strategic Breakdown

Let’s delve deeper into each option with illustrative examples.

Direct Ownership: The Path of Control and "Sweat Equity"

This involves buying physical property, such as a residential home, duplex, or commercial building. It offers the highest degree of control and potential for significant appreciation, especially if you’re willing to put in work (sweat equity).

Case Study: Meet Sarah, a 35-year-old living in a growing suburb outside Denver. She utilized an FHA loan to purchase a duplex, living in one unit and renting out the other. Her tenant’s rent covers a significant portion of her mortgage, allowing her to build equity rapidly. While she handles maintenance and tenant screening, her net worth has grown substantially faster than her peers.

REITs: The Easiest Way to Become a Landlord

REITs are companies that own, operate, or finance income-producing real estate across various sectors (apartments, warehouses, shopping centers, hotels). They trade on major stock exchanges, making them highly liquid and accessible.

Case Study: Consider Tom, a beginner investor who wants real estate exposure without the operational hassle. He allocates $200 a month to a diversified REIT Exchange Traded Fund (ETF) through his brokerage account. This gives him a small, professionally managed stake in hundreds of properties nationwide, allowing him to collect dividends passively without ever dealing with a leaky faucet.

Crowdfunding: The High-Risk, High-Reward Frontier

Real estate crowdfunding platforms allow multiple investors to pool capital online to fund specific real estate projects, often in commercial development or high-yield ventures that were once exclusive to institutions.

Case Study: Alex, an experienced investor comfortable with higher risk, is looking for opportunities beyond the stock market. Through a reputable crowdfunding platform, he invests $5,000 in a new apartment complex development in Austin, Texas. While his capital is locked in for five years, the project targets a potential 20% annualized return, significantly higher than traditional investments.

Key Factors to Consider Before You Invest in 2026

Before committing to any real estate investment, a thorough self-assessment is paramount.

Your Financial Health

Do you have a fully funded emergency savings account (3-6 months of living expenses)? Are you carrying high-interest debt, such as credit card balances? It’s generally advisable to solidify your financial foundation before taking on the illiquidity and potential risks associated with real estate.

Your Time Horizon

Real estate is not a “get-rich-quick” scheme. Direct ownership, and especially crowdfunding, require a long-term perspective (typically 5+ years) to weather market fluctuations and realize significant returns. REITs offer daily liquidity but still perform best as part of a long-term portfolio.

Your Risk Tolerance

How comfortable are you with market volatility or the possibility of property value depreciation? Are you prepared for unexpected repair costs in a rental property or the potential failure of a crowdfunding project? An honest assessment of your emotional and financial capacity for risk is crucial.

Conclusion: Your Verdict for the 2026 Real Estate Market

The US real estate market entering 2026 is undoubtedly nuanced. It presents a landscape of both persistent challenges, like affordability constraints, and enduring opportunities for wealth creation.

Key Takeaways:

The Market: The 2026 market is defined by higher interest rates and significant regional variations; data-driven decisions and careful location analysis are essential.

The Options: Direct ownership offers unparalleled control and potential for high returns but demands significant capital and effort. REITs provide a liquid, diversified, and passive entry point. Crowdfunding offers access to unique, potentially high-growth deals with a lower capital barrier but higher risk.

The Decision: The “best” real estate investment isn’t a one-size-fits-all answer. It’s determined by your personal financial health, time horizon, and risk tolerance, all aligned with your long-term wealth-building goals.

Which real estate path are you leaning towards for 2026? Share your thoughts and questions in the comments below! For further guidance, consider downloading our free Real Estate Investor Checklist to help kickstart your journey.

Frequently Asked Questions

Can I invest in real estate with very little money?

Yes! While direct property ownership typically requires a significant down payment, you can start investing in real estate with as little as the cost of a single share of a REIT (often under $100) or through some crowdfunding platforms that have minimums of $500-$1,000.

Is the US housing market in a bubble that's about to burst?

Most economists believe the current market, while expensive, is not a repeat of the 2008 bubble. Factors like stricter lending standards, limited inventory, and genuine demand differ significantly. However, regional corrections and price plateaus are possible in some areas.

Are REITs a good long-term investment?

Historically, REITs have provided competitive long-term returns and attractive dividend yields. They offer diversification benefits and a relatively passive way to participate in real estate market growth. However, like all stock market investments, their value can fluctuate.