Invest1now.com Cryptocurrency The Ultimate Guide to Understanding, Investing, and Thriving in the Digital Currency Revolution

Introduction: Invest1now.com Cryptocurrency Why Everyone’s Talking About Crypto

Invest1now.com Invest1now.com Cryptocurrencyisn’t just buzzing—it’s roaring. Bitcoin’s price swings dominate X posts, Ethereum’s upgrades fuel tech forums, and even your uncle’s asking about Dogecoin at dinner. The confusion? Overwhelming. The hype? Unmissable. Headlines in 2025 scream of trillion-dollar market caps, regulatory showdowns, and blockchain breakthroughs. Why care? Because crypto’s no longer a fringe experiment—it’s a seismic shift in finance, tech, and power.

This guide isn’t just a primer; it’s your roadmap. You’ll master crypto basics, decode its US boom, uncover real-world uses, and learn how to invest smarter in 2025. Inflation’s eating savings, Gen Z’s all-in, and Wall Street’s betting big—crypto’s moment is now. Let’s cut through the noise and get you ahead.

Cryptocurrency 101: A Deeper Dive for Curious Minds

What Is Cryptocurrency, Really?

Invest1now.com Cryptocurrency is decentralized digital money, cryptographically secured, and powered by blockchain. It’s not a PayPal balance—it’s a trustless system where code replaces banks.

How It Breaks from Fiat Money

Fiat’s government-issued, inflation-prone, and centralized. Crypto? Peer-to-peer, often capped in supply (Bitcoin’s 21M), and immune to printing presses. No FDIC safety net, but no bailouts either.

What Drives Its Value?

Scarcity (Bitcoin’s halving), utility (Ethereum’s dApps), and adoption (El Salvador’s BTC experiment). Speculation fuels volatility, but fundamentals—like network security—anchor long-term worth.

Blockchain: The Engine Explained

Picture a tamper-proof ledger, replicated across 10,000+ nodes. Each “block” logs transactions, chained via hashes—alter one, and the network screams foul. It’s a trust machine, not just a database.

✅ Infographic: “Crypto vs Fiat vs Stocks” – Crypto’s borderless freedom, fiat’s legal tender, stocks’ equity stakes—visualized with 2025 market stats.

Types of Cryptocurrencies: Beyond the Buzzwords

Bitcoin (BTC) – The Unshakable Titan

Born 2009, capped at 21M coins, it’s “digital gold” with a $1.5T+ market cap in 2025. Miners secure it; HODLers worship it.

Ethereum (ETH) – The Programmable Powerhouse

Beyond a coin, Ethereum’s a platform. Smart contracts—self-executing code—run DeFi, NFTs, and Web3. Post-Dencun upgrade, it’s faster, cheaper, and a $600B+ giant.

Stablecoins (USDT, USDC, DAI) – Stability Meets Crypto

Pegged 1:1 to USD, they dodge volatility. USDC’s transparency beats USDT’s opacity; DAI’s decentralized twist intrigues purists.

Altcoins: The Wildcards

Solana (65,000 tx/sec), Cardano (proof-of-stake pioneer), Dogecoin (meme king)—each carves a niche. Newcomers like Aptos and Sui push scalability limits.

💡Comparison Table:

| Coin | Core Use | Tx Speed | Market Cap (2025) | Unique Edge |

|---|---|---|---|---|

| Bitcoin | Store of Value | 7 tx/sec | $1.5T+ | First-mover trust |

| Ethereum | Smart Contracts | 30 tx/sec | $600B+ | dApp ecosystem |

| USDC | Stable Trading | Varies | $55B+ | Audited reserves |

| Solana | High-Speed DApps | 65,000 tx/sec | $90B+ | Low-cost tx |

How Cryptocurrency Works: The Tech Unveiled

Blockchain with Real Analogies

Think of blockchain as a global notary—every deal’s stamped, visible, and unchangeable. Nodes (computers) agree via consensus, no boss needed.

Mining vs Staking: Powering the Network

Mining (Bitcoin): Solve math puzzles, burn energy, earn coins—think gold prospecting. Staking (Ethereum 2.0): Lock up ETH, validate blocks, earn rewards—like a savings bond. Staking’s 99% less energy-hungry.

Wallets and Keys: Your Crypto Vault

Public key = your address; private key = your signature. Hot wallets (apps) are convenient; cold wallets (USB-like devices) are fortresses. Lose your key? Kiss your funds goodbye.

Transactions: The Flow

Send 0.1 BTC: Your wallet signs it, miners bundle it into a block, the network confirms—done in ~10 minutes. Ethereum’s Layer 2s (e.g., Arbitrum) slash that to seconds.

🛠 Tool Tip: Link to “Crypto Wallet Setup Guide” – From MetaMask to Ledger Nano X.

Why Crypto’s Exploding in the US in 2025

- Inflation Hedge: With 7%+ inflation, dollars bleed value—BTC’s scarcity shines.

- Gen Z/Millennials: 60% of US crypto holders are under 35 (Pew, 2025), drawn by tech and rebellion.

- Startup Surge: 200+ US crypto firms raised $10B+ in 2024—think Circle, Alchemy.

- Wall Street’s Pivot: BlackRock’s Bitcoin ETF holds $20B; Fidelity’s crypto custody booms.

Real-World Uses of Crypto in 2025: Beyond Hype

Payments Revolution

Walmart tests BTC checkout; Expedia books flights with ETH. Charities like Red Cross take instant, low-fee crypto donations.

DeFi: Banking Reimagined

Borrow at 5% APR on Aave, earn 8% staking USDC—no bank approval. $200B locked in DeFi by Q1 2025 (DeFiLlama).

NFTs: Ownership Evolved

Sotheby’s sells $50M in NFT art; virtual land in Decentraland hits $1M. Provenance is blockchain-verified.

Remittances: Borderless Cash

Send $500 to Mexico via Stellar—$2 fee, 5 seconds. Compare that to Western Union’s $15+.

Web3: Power to Users

Own your data on apps like Brave or Audius—crypto rewards creators, not ad giants.

Is Crypto Safe? Risks and Realities

Volatility: The Double-Edged Sword

Bitcoin’s 30% drops scare newbies, but 2025’s $80K floor shows resilience.

Hacks and Scams

$1.2B stolen in 2024 (Chainalysis)—phishing and exchange breaches lead. Rug pulls tanked 300+ DeFi projects.

Key Loss: No Safety Net

1M+ BTC lost forever to forgotten keys. Backup your seed phrase offline.

✅ Checklist: “Top 7 Crypto Safety Tips” – 2FA, hardware wallets, phishing drills, audited projects.

Legal and Tax Landscape in the US: 2025 Edition

Legal Status

Crypto’s legal, but nuanced. SEC sues Ripple (again); CFTC greenlights BTC futures.

IRS Tax Rules

Every trade’s taxable—short-term gains hit 37% for high earners. Mining/staking? Income tax applies.

Regulation Horizon

Bipartisan bill (Lummis-Gillibrand) eyes 2025 passage—clarity on stablecoins, custody.

Reporting

Form 8949 for trades; 1099-B from Coinbase. Undeclared gains? IRS audits spiked 200% in 2024.

📎 Link: IRS crypto tax hub – irs.gov/crypto.

Getting Started: Your 2025 Crypto Playbook

Step 1: Pick an Exchange

Coinbase (beginner-friendly), Kraken (security-first), Gemini (regulated).

Step 2: KYC

ID + selfie—takes 10 minutes.

Step 3: Buy Crypto

Start with $50 in BTC or ETH via ACH.

Step 4: Store It

Hot (MetaMask) for daily use; cold (Trezor) for HODLing.

Step 5: Track and Secure

CoinStats + 2FA + YubiKey = peace of mind.

📦 Download: “Crypto Starter Kit (PDF)” – Exchange reviews, wallet setup, tax cheat sheet.

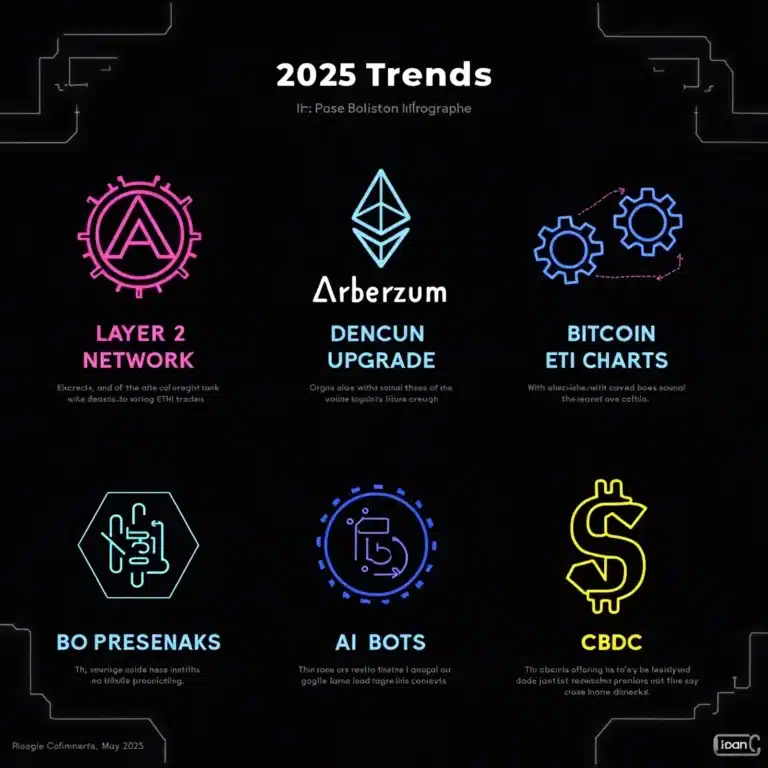

Crypto Trends to Watch in 2025: The Cutting Edge

- Layer 2 Boom: Arbitrum’s $5B TVL; Optimism’s EVM upgrades.

- Ethereum’s Dencun: Sharding slashes gas fees 80%.

- Bitcoin ETFs: $50B AUM, per Bloomberg.

- AI x Crypto: AI bots optimize yield farming (e.g., Yearn).

- CBDCs: Fed’s digital dollar pilot—threat or ally?

Advanced Investment Strategies for 2025

Holing vs Trading

HODL BTC for 5+ years—halving cycles predict $150K by 2028. Trade SOL for 20% weekly swings.

Dollar-Cost Averaging (DCA)

$200 monthly into ETH averages out dips—up 300% since 2020.

Staking/Yields

Stake 32 ETH for 4-6% APR; farm UNI on Sushi Swap for 15%+.

Portfolio Diversification

50% BTC, 30% ETH, 20% altcoins (SOL, LINK)—balance risk/reward.

Emotional Mastery

FOMO bought ETH at $4K? FUD sold BTC at $30K? Use alerts, not headlines.

Tools and Resources: Your Crypto Arsenal

- Trackers: CoinGecko (real-time), Glassnode (on-chain data).

- Wallets: Ledger Nano X, Trust Wallet, SafePal.

- News: The Block, Messari, X’s #CryptoTwitter.

- Learn: Binance Academy, Chainlink’s dev docs.

- Communities: r/CryptoMarkets, Discord’s Bankless DAO.

Crypto Scams in 2025: Stay Sharp

| Scam | Telltale Sign | Defense Strategy |

|---|---|---|

| Fake Airdrops | “Claim 1 BTC free” | Check official X |

| Phishing | “Urgent: Reset wallet” | Hover over links |

| Pump/Dump | 500% spike, Telegram hype | Research fundamentals |

| Clone Wallets | App typos (e.g., “Metamaskk”) | Official stores only |

Final Thoughts: Should You Jump Into Crypto in 2025?

Crypto’s a paradox: freedom meets volatility, innovation meets scams. Benefits—decentralization, returns, ownership—clash with risks. With $3T+ market cap and Fed’s CBDC looming, 2025’s a pivot year. Invest? Only with eyes open.

CTA: Subscribe for Weekly Crypto Insights—expert tips, no fluff.

Disclaimer: Not financial advice; DYOR.

Is Cryptocurrency Still Worth Investing in During 2025?

Yes, with a $3T+ market cap and institutional adoption (e.g., Bitcoin ETFs at $50B AUM), crypto’s momentum is strong. But volatility persists—research and risk tolerance are key.

What’s the Best Cryptocurrency for Beginners in the US?

Bitcoin (BTC) for stability and Ethereum (ETH) for utility lead the pack. Start small—$50 on Coinbase gets you in the game.

How Do I Safely Store My Crypto in 2025?

Cold wallets like Ledger Nano X or Trezor, paired with multisig setups (e.g., Casa), are gold standards. Back up your seed phrase offline—1M+ BTC are lost forever without it.

Can I Use Crypto for Everyday Purchases in the US?

Absolutely—BitPay powers payments at retailers like Newegg, and Walmart’s testing BTC checkout. Stablecoins like USDC keep it practical.

How Does the IRS Tax Crypto in 2025?

Every trade, sale, or staking reward is taxable. Short-term gains hit up to 37%; use Form 8949 and tools like Koinly. Audits jumped 200% in 2024—don’t skip.

Is Crypto Legal in All 50 US States?

Yes, but regulations vary. New York’s BitLicense and Hawaii’s exchange rules tighten the screws—check local laws before diving in.

What’s the Difference Between Hot and Cold Wallets?

Hot wallets (e.g., MetaMask) are online, fast, and hackable. Cold wallets (e.g., Trezor) are offline, secure, and ideal for HODLing. Use both smartly.

How Can I Spot a Crypto Scam in 2025?

Fake airdrops (“free BTC”), phishing emails, and pump-and-dump Telegram groups are rampant. Verify everything—official X accounts and domain names are your friends.

What Are Layer 2 Solutions, and Why Do They Matter?

Layer 2s like Arbitrum and Optimism turbocharge Ethereum—think 80% cheaper gas fees and seconds-fast transactions. They’re DeFi and NFT game-changers in 2025.

Should I Worry About the US Digital Dollar (CBDC)?

The Fed’s CBDC pilot looms, but it’s centralized—crypto’s opposite. It might coexist, not kill, decentralized coins like BTC. Watch, don’t panic.