Unsecured Credit Builder Loan: A Smart Way to Boost Your Credit Score

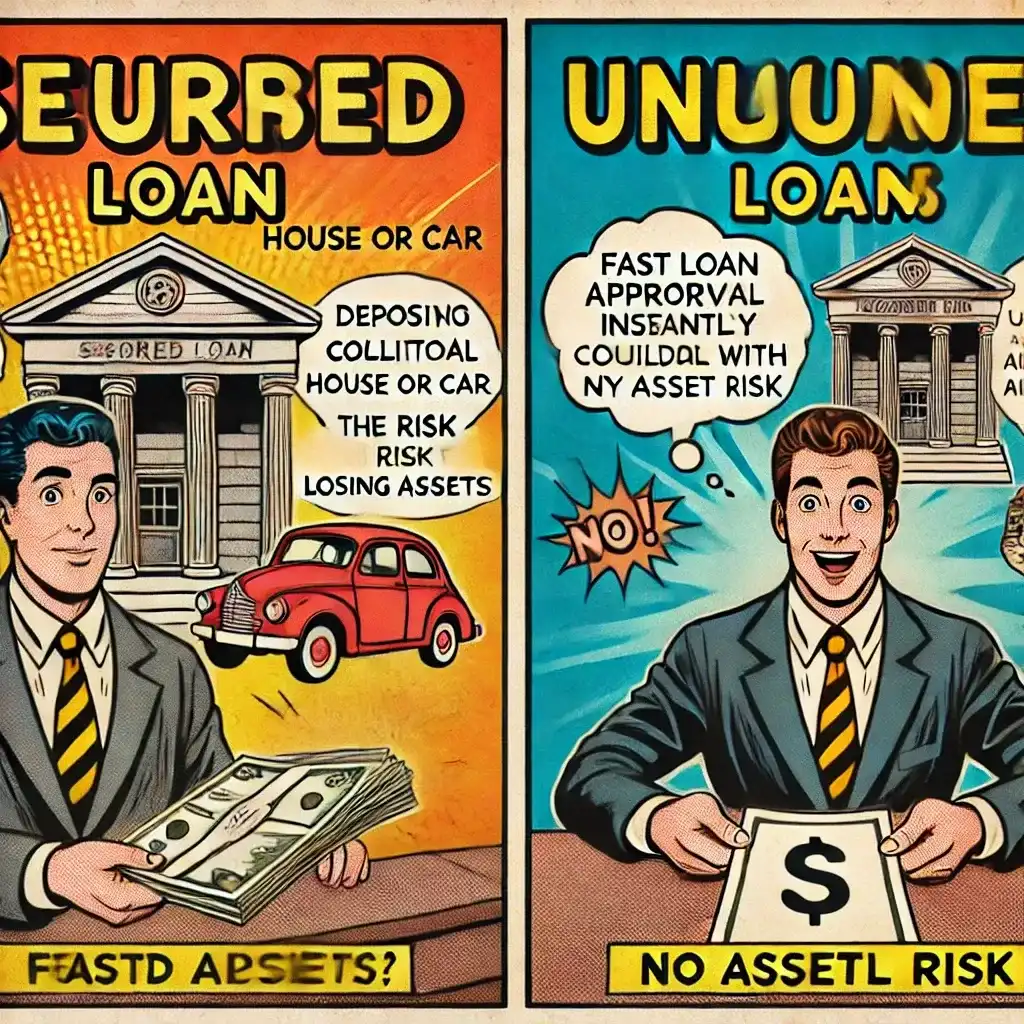

Building a strong credit history is essential, but not everyone has access to traditional loans. This is where an unsecured credit builder loan comes into play. Unlike secured loans that require collateral, an unsecured credit builder loan offers a way to improve your credit score without the risk of losing assets.

What is an Unsecured Credit Builder Loan?

An unsecured credit builder loan is a type of loan designed for individuals looking to build or improve their credit score. Unlike secured loans, it does not require any collateral, making it accessible to a wider range of borrowers. These loans work by lending a small amount, which is repaid in fixed monthly payments. Each on-time payment is reported to credit bureaus, helping you establish a positive credit history.

How Does an Unsecured Credit Builder Loan Work?

- Application Process: Borrowers apply for an unsecured credit builder loan through banks, credit unions, or online credit score platforms.

- Loan Approval: Lenders evaluate creditworthiness based on past financial history and income.

- Funds Allocation: The loan amount is deposited in a savings account and cannot be accessed until full repayment.

- Monthly Repayments: The borrower makes fixed credit-building payments, which are reported to credit bureaus.

- Credit Score Improvement: Upon successful repayment, the borrower gains access to the saved funds and benefits from an improved credit history.

Benefits of an Unsecured Credit Builder Loan

- No Collateral Needed: Since it is unsecured, you don’t have to put up any assets.

- Improves Credit Score: Regular credit-building payments contribute to a better credit history.

- Access to Better Loans: Once your credit score improves, you may qualify for better loan terms.

- Flexible Loan Terms: Many lenders offer builder loans with various repayment plans.

- Safe Way to Build Credit: Unlike credit cards, an unsecured credit builder loan prevents overspending while improving creditworthiness.

Who Should Consider an Unsecured Credit Builder Loan?

- Individuals with low credit scores looking to improve their creditworthiness.

- Young adults or students without a credit history.

- People recovering from financial setbacks such as bankruptcy.

- Anyone looking for a structured way to build loan credit responsibly.

How to Qualify for an Unsecured Credit Builder Loan?

- Check Your Credit Score: Even if you have a low credit score, many lenders still approve these loans.

- Compare Lenders: Look for financial institutions offering credit builder loans with low interest rates.

- Apply Online: Many lenders allow you to apply for a credit-building loan online.

- Make Timely Payments: Your repayment history impacts your credit score significantly.

Key Factors to Consider Before Taking an Unsecured Credit Builder Loan

1. Loan Terms and Interest Rates

Before applying, research different lenders to find the best credit-building loan terms and interest rates. Some lenders offer low APRs, while others may have higher fees.

2. Monthly Repayment Plan

Ensure that the monthly payments fit within your budget. Missing payments can hurt your credit score instead of improving it.

3. Reporting to Credit Bureaus

Not all lenders report to the three major credit bureaus (Experian, Equifax, TransUnion). Choose a lender that ensures your credit-building efforts are recognized.

4. Eligibility Requirements

Some lenders may require proof of income or a minimum credit score to qualify. Check eligibility criteria before applying.

Best Lenders Offering Unsecured Credit Builder Loans

- Online Credit Platforms: Many online lenders specialize in credit-building options.

- Credit Unions: Often offer lower interest rates and better terms.

- Banks with Loan Credit Programs: Some banks provide loan credit plans to help with credit building.

Unsecured Credit Builder Loan vs. Secured Credit Builder Loan

| Feature | Unsecured Credit Builder Loan | Secured Credit Builder Loan |

|---|---|---|

| Collateral Required | No | Yes (Savings or Deposit) |

| Risk Level | Lower | Higher (Collateral Required) |

| Approval Chances | Moderate | Higher |

| Loan Amount | Smaller | Larger |

| Credit Score Impact | Positive with Timely Payments | Positive with Timely Payments |

How to Maximize the Benefits of an Unsecured Credit Builder Loan?

- Make Timely Payments: On-time payments significantly boost your credit score.

- Monitor Your Credit Report: Regularly check your credit history to track progress.

- Avoid Multiple Loans: Too many loans can negatively impact your credit score.

- Consider Additional Credit-Building Methods: Use a combination of credit-building loans, secured credit cards, and responsible financial habits.

Final Thoughts

If you want to build or repair your credit score, an unsecured credit builder loan is a great option. With no collateral required and a structured repayment plan, you can work towards financial stability. Start today by comparing different credit builder loan options and choose the one that fits your needs best.

FAQs

What is an unsecured credit builder loan?

It’s a special type of loan that doesn’t require collateral and helps you improve your credit score over time.

How does an unsecured credit builder loan work?

You take a fixed amount loan, make timely monthly repayments, and these payments are reported to credit bureaus, which helps in boosting your credit score.

Do I need a good credit score to qualify for an unsecured credit builder loan?

No! This loan is specifically designed for individuals with low or no credit history to help them build their credit profile.

Can an unsecured credit builder loan actually improve my credit score?

Yes! By making on-time payments, your credit utilization improves, and your score gradually increases over time.